Indicators on Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program You Need To Know

Wiki Article

Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program Fundamentals Explained

Table of ContentsNot known Details About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program Excitement About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund ProgramThe Main Principles Of Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program The Main Principles Of Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

Yes, these circulations will be treated like other distributions, as well as strained in AGI. The CARES Act influences AGI by enabling distributions to be taxed over three years - IRS ERC ERTC 2020-2021 COVID BUSINESS INCOME TAX REFUND PROGRAM. For individuals that pick this alternative, the circulation revenue will certainly additionally be spread out throughout three tax years in Vermont. Home Income includes AGI, as well as ROTH IRA circulations that are not consisted of in AGI.The circulations that are spread across 3 years will certainly likewise be spread out throughout 3 years of house revenue. No. Since the COVID-related circulations will certainly be exhausted as gross earnings and will certainly not go through the Federal 10% extra tax on circulations from eligible strategies, there will certainly not be any added Vermont tax obligation under this section.

We and also the 3rd parties that give content, functionality, or business solutions on our website may utilize cookies to gather details about your surfing activities in order to provide you with even more appropriate web content as well as promotional products, on and off the internet site, as well as aid us comprehend your interests and also enhance the website - IRS ERC ERTC 2020-2021 COVID BUSINESS INCOME TAX REFUND PROGRAM.

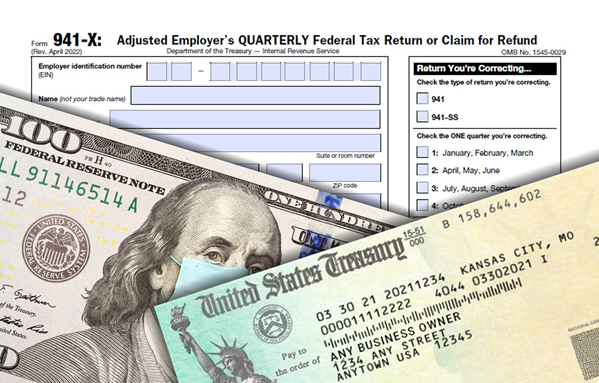

Although the Internal Revenue Service (the "INTERNAL REVENUE SERVICE") has not refuted any such event the receipt of the tax obligation credit report, in the vast bulk of instances, the clients have actually not yet received the funds. At the end of May, the internal revenue service explained the source of the hold-ups as well as also the condition of the stockpile - IRS ERC ERTC 2020-2021 COVID BUSINESS INCOME TAX REFUND PROGRAM.

Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program Can Be Fun For Everyone

This has actually triggered lots of businesses that applied for the ERC to experience a longer than anticipated tax refund." The IRS has actually kept in mind that they are currently opening their mail within the regular timespan. However, the adjustment in treatments, along with the quantity of demands, have actually produced a lengthy backlog.

Adding 2021 returns, nonetheless, the number of unprocessed 941s (which, again, in Internal revenue service speak consists of the 941-X) swells to 1. It is re-routing tax obligation returns from IRS workplaces that are additionally behind to those that have much more staff schedule.

The Facts About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program Revealed

The Internal revenue service hold-ups ought to not create companies who are qualified to the tax obligation credit scores based on their reporting placements to think twice to go after a fantastic read such funds.Our company believe it is suitable to apply Accountancy Requirements Update (ASU) Subtopic 958-605, Contributions Gotten as well as Contributions Made, to the recording of this revenue. The ERC is considered a conditional grant, as a company only gets approved for the transfer of possessions if it has actually More Bonuses gotten over the obstacle of qualification. Per ASU 958-10-75-2: conditional pledges to provide, which have donor-imposed conditions that represent an obstacle that has to relapse in addition to a right of release from obligation shall be recognized when the problem or problems on which they depend are considerably fulfilled, that is, when a conditional promise comes to be genuine.

If the obstacles have actually been met as shown above, a receivable needs to be identified for the portion that has actually not been gotten, even if the forms have not been filed. Submitting the kinds is an administrative function as well as is not thought about a barrier to earnings acknowledgment. To precisely videotape the profits and associated receivable, it is crucial to have identified qualification, calculated the credit history, and also, preferably, be in the process of filing the forms prior to recording the receivable.

In keeping with appropriate audit treatment for nonprofits, costs as well as contributions should be tape-recorded gross. The pay-roll tax obligation liability will certainly be accumulated for the whole quantity before the application of the ERC. The ERC is taped as either a debit to cash or accounts receivable and also a debt to payment or grant earnings, according to the timeline noted over.

The 10-Minute Rule for Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

When the earnings is recorded, it is unlimited, as any type of implied time constraint would certainly have been satisfied upon the due date of the receivable. In addition, there is no function restriction affixed to the ERC.Statement of Financial Position An existing receivable must be tape-recorded for the ERC quantity that was not taken as a credit scores on payroll tax obligation reporting types. (You can assert a credit score that is more than the tax obligations due on Type 941, Employer's Quarterly Federal Tax obligation Return.) Notes Disclose even more details regarding the nature of the ERC in either incomes or the A/R explanation, such as this instance: Legislations and guidelines worrying government programs, consisting of the Worker Retention Credit developed by the Coronavirus Help, right here Relief, and also Economic Safety (CARES) Act, are intricate as well as based on differing interpretations.

There can be no assurance that regulatory authorities will certainly not challenge the Organization's case to the ERC, and it is not feasible to identify the influence (if any) this would have upon the Company. With any luck, these considerations assist you as you determine exactly how to represent the ERC in your company and show the credit score in your reports.

Report this wiki page